A stock investor looks up in a brokerage house in Shanghai. Chinese authorities have launched frantic efforts to shore up plunging stock prices following another 5.7 per cent decline in the country's main market index on Friday. Source: AP

Chinese chaos worse than Greece: Chinese stock market loses $3.2 trillion, authorities inject cash

WHILE the world worries about Greece, there’s an even bigger problem closer to home: China.

A stock market crash there has seen $3.2 trillion wiped from the value of Chinese shares in just three weeks, triggering an emergency response from the government and warnings of “monstrous” public disorder.

And the effects for Australia could be serious, affecting our key commodity exports and sparking the beginning of a period of recession-like conditions.

“State-owned newspapers have used their strongest language yet, telling people ‘not to lose their minds’ and ‘not to bury themselves in horror and anxiety’. [Our] positive measures will take time to produce results,” writes IG Markets.

“If China does not find support today, the disorder could be monstrous.”

In an extraordinary move, the People’s Bank of China has begun lending money to investors to buy shares in the flailing market. The Wall Street Journal reports this “liquidity assistance” will be provided to the regulator-owned China Securities Finance Corp, which will lend the money to brokerages, which will in turn lend to investors.

The dramatic intervention marks the first time funds from the central bank have been directed anywhere other than the banks, signaling serious concern from authorities about the crisis.

At the same time, Chinese authorities are putting a halt to any new stock listings. The market regulator announced on Friday it would limit initial public offerings — which disrupt the rest of the market — in an attempt to curb plunging share prices.

While the exact amount of assistance hasn’t been revealed, the WSJ reports no upper limit has been set.

All short-selling — the practice of betting that stocks will fall — has been banned, and Chinese media has rushed to reassure citizens.

Yesterday, shares in big state companies soared in response to the but many others sank as jittery small investors tried to cut their losses, Associated Press reports. The market benchmark Shanghai Composite closed up 2.4 percent but still was down 27 percent from its June 12 peak.

Experts fear it could turn into a full-blown crash introducing even more uncertainty into global markets as Europe teeters on the edge of a potential euro zone exit by Greece, after Sunday’s controversial referendum.

WHAT DOES IT MEAN FOR AUSTRALIA?

For Australia, the market crash in China is likely to impact earnings on key exports iron ore and coal, further slashing government revenue, while also putting downward pressure on the Australian dollar.

Jordan Eliseo, chief economist with ABC Bullion, said it was important to remember that the amount of wealth Chinese citizens have tied up in the stock market is relatively minor compared with western investors.

Stocks only make up about 8 per cent of household wealth in China, compared with around 20 per cent in developed nations.

“The market crash there is generating headlines, but it’s not going to have the same impact as a comparable crash would in a developed market,” he said.

“What it means for Australia, though, is it’s very clear there are some serious imbalances in the Chinese economy, and the rate of growth they’ve enjoyed in the past is over. There’s no question our export earnings are going to take another hit.”

Mr Eliseo predicts Australia is likely to experience “recession-like” conditions such as negative wage growth for many years to come. “I believe that’s going to be the new norm,” he said.

CRACKDOWN AS PANIC TRIGGERS ‘SUICIDE’ RUMOURS

Underscoring growing jitters amid the three-week sell-off, police in Beijing detained a man on Sunday for allegedly spreading a rumor online that a person jumped to their death in the city’s financial district due to China’s precarious stock markets.

The 29-year-old man detained was identified by the surname Tian, and is a manager at a technology and science company in Beijing, police said in a post on their official microblog.

Police said Tian’s alleged posting of the rumor took place Friday and called on internet users to obey laws and regulations, not to believe and spread rumors, and to cooperate with police.

The state-run Xinhua news agency reported that Tian allegedly posted the rumors with video clips and screenshots Friday afternoon.

The post, which is said to have gone viral, “provoked emotional responses among stock investors who suffered losses over the past weeks”, Xinhua said.

Xinhua added that a police investigation showed that the video in question had been shot on Friday morning in the eastern Chinese province of Jiangsu where a man had jumped to his death. Local police there were investigating that case, Xinhua said.

The original post was unavailable Sunday on China’s tightly controlled social media, where authorities are quick to delete controversial material. - Jews News / News.com.au

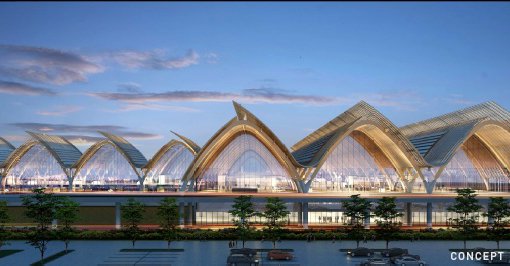

Mactan-Cebu touted to be first of several world-class airports

Mactan-Cebu touted to be first of several world-class airports